MORE FREE TERM PAPERS MANAGEMENT:

|

|||||||||||||||||||||||||

MANAGERIAL ECONOMICS

IMPACT OF INDIRECT TAX ON COSUMER EQULIBRIUM

TAX

Tax is a sum of money demanded by a government for its support or for specific facilities or services, levied upon incomes, property, sales, etc.

In general, tax can be defined as a levy or other type of a financial charge or fee imposed by state or central governments on legal entities or individuals.

Local authorities like local governments, provincial governments, counties and municipal corporations also have the right to impose taxes. The rates, rules, and regulations of taxation differ from one country to another and they are complex in character. Tax is a principal source of revenue for a country's government.

Governments use taxes to fund welfare and public services. These services can include education systems, health care systems, and pensions for the elderly, unemployment benefits, and public transportation. Energy, water and waste management systems are also common public utilities.PURPOSE FOR TAXATION

Taxation has four main purposes or effects: Revenue, Redistribution, Reprising, and Representation.

The main purpose is Revenue: taxes raise money to spend on armies, roads, schools and hospitals, and on more indirect government functions like market regulation or legal systems.

A second is Redistribution. Normally, this means transferring wealth from the richer sections of society to poorer sections.

A third purpose of taxation is Reprising. Taxes are levied to address externalities: tobacco is taxed, for example, to discourage smoking, and a carbon tax discourages use of carbon-based fuels.

A fourth, consequential effect of taxation in its historical setting has been Representation. Ruler’s tax citizens and citizens demand accountability from their rulers as the other part of this The American revolutionary slogan "no taxation without representation" implied this: bargain. Studies have shown that direct taxation (such as income taxes) generates the greatest degree of accountability and better governance, while indirect taxation tends to have smaller effects.TAX CLASSIFICATION

Direct tax

A direct tax is a form of tax is collected directly by the government from the persons who bear the tax burden. Taxable individuals file tax returns directly to the government. Examples of direct taxes are corporate taxes, income taxes, and transfer taxes.

Indirect tax

An indirect tax is a form of tax collected by mediators who transfer the taxes to the government, and also perform functions associated with filing tax returns. The customers bear the final tax burden. As a result these taxes are an important part of the total cost. As a result these taxes are an important part of the total cost.

There are other types of taxes, which may either be direct tax or indirect taxes, including capital gains tax, corporation tax, consumption tax, inheritance tax, property tax, excise duty, retirement tax, tariffs, wealth tax or net worth tax, toll tax, and poll tax.

CONSUMER EQUILIBRIUM

When consumers make choices about the quantity of goods and services to consume, it is presumed that their objective is to maximize total utility. In maximizing total utility, the consumer faces a number of constraints, the most important of which are the consumer's income and the prices of the goods and services that the consumer wishes to consume. The consumer's effort to maximize total utility, subject to these constraints, is referred to as the consumer's problem. The solution to the consumer's problem, which entails decisions about how much the consumer will consume of a number of goods and services, is referred to as consumer equilibrium.

Determination of consumer equilibrium

Consider the simple case of a consumer who cares about consuming only two goods: good 1 and good 2. This consumer knows the prices of goods 1 and 2 and has a fixed income or budget that can be used to purchase quantities of goods 1 and 2. The consumer will purchase quantities of goods 1 and 2 so as to completely exhaust the budget for such purchases.

This condition states that the marginal utility per dollar spent on good 1 must equal the marginal utility per dollar spent on good 2. If, for example, the marginal utility per dollar spent on good 1 were higher than the marginal utility per dollar spent on good 2, then it would make sense for the consumer to purchase more of good 1 rather than purchasing any more of good 2. After purchasing more and more of good 1, the marginal utility of good 1 will eventually fall due to the law of diminishing marginal utility, so that the marginal utility per dollar spent on good 1 will eventually equal that of good 2. Of course, the amount purchased of goods 1 and 2 cannot be limitless and will depend not only on the marginal utilities per dollar spent, but also on the consumer's budgetIMPACT OF INDIRECT TAX

Indirect taxes are imposed by the government on producers - but the burden of the tax can be passed onto consumers depending on the price elasticity of demand and elasticity of supply for the product. Therefore in most cases, consumers end up paying some or all of any indirect tax introduced into a market.

An example of this is the air passenger duty per flight for domestic flights. Most airlines pass this straight onto the consumer when the final price is published and customer pay the all weight.

A marginal tax on the sellers of a good will shift the supply curve to the left until the vertical distance between the two supply curves is equal to the per unit tax; when other things remain equal, this will increase the price paid by the consumers (which is equal to the new market price), and decrease the price received by the sellers. Alternatively, a marginal tax on consumption will shift the demand curve to the left; when other things remain equal, this will increase the price paid by consumers and decrease the price received by sellers by the same amount as if the tax had been imposed on the sellers, although in this case, the price received by the sellers would be the new market price. The end result is that no matter who is taxed, the price sellers receive will decrease and the price consumers pay will increase.

Impact on Consumer Equilibrium

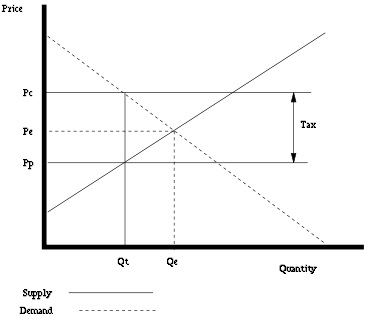

The effect of this type of tax can be illustrated on a standard supply and demand diagram. Without a tax, the equilibrium price will be at Pe and the equilibrium quantity will be at Qe . After a tax is imposed, the price consumers pay will shift to Pc and the price producers receive will shift toPp. The consumers' price will be equal to the producers' price plus the cost of the tax. Since consumers will buy less at the higher consumer price (Pc) and producers will sell less at a lower producer price (Pp), the quantity sold will fall from Qe to Qt.

The effect of this type of tax can be illustrated on a standard supply and demand diagram. Without a tax, the equilibrium price will be at Pe and the equilibrium quantity will be at Qe . After a tax is imposed, the price consumers pay will shift to Pc and the price producers receive will shift toPp. The consumers' price will be equal to the producers' price plus the cost of the tax. Since consumers will buy less at the higher consumer price (Pc) and producers will sell less at a lower producer price (Pp), the quantity sold will fall from Qe to Qt.

Role of Elasticity and Competition

The burden of an indirect tax can be passed onto the consumer by the producer - but not all of it. The ability to pass the burden of the tax depends on price elasticity of demand and price elasticity of supply. When demand is inelastic, most of the tax is passed onto the consumer. When demand is elastic, the producer must carry most of the burden of the tax - they risk losing a large size of total demand if they pass the tax onto the consumer in the form of higher prices.

The effect of indirect taxes on goods and services also depends on the degree of competition between producers in a market. In some industries - particularly those for luxury goods where the demand is relatively elastic - intense price competition between producers may limit the extent to which a firm is prepared to pass on any extra taxes to consumers.Taxation And Government Revenue

The Government would rather place indirect taxes on inelastic commodities because the tax causes a small fall in the quantity consumed and as a result the total revenue from the tax will be greater. A good example of this is the high level of duty on cigarettes and petrol.

Demand for both products changes little when a few extra pence are added to the price of a packet of cigarettes or a litre of fuel. Rising prices and higher taxes leads to a sharp rise in total government tax revenue. Cigarette and alcohol taxes provide some of the largest sources of tax revenue for the government every year.Merits of Indirect Taxes

Indirect taxes are easy to implement as these are not related directly to the taxpayer income and depends on levied if the purchase or that particular transaction take place for which tax will due. Tax payer feels comfortable to pay tax on individual transaction. Usually taxpayer even doesn’t know that if he is paying any type of tax.

It is easy to make changing in the tax pattern and rates as compare to direct taxes. Policy makers normally balance their deficit budget through indirect taxes.

Collection of indirect tax is certain as when there will be a sale of finish product the government generates revenue. Indirect taxes are used to change the buying behaviour of consumers. Like tobacco and liquor have the high tax rates.

Demerits of Indirect Taxes

Fixed Income Class suffers from these taxes as prices of the products increase and their purchasing power shrinks. Prices of commodities increase with indirect taxes. The upward trend of prices of the product cause cost push inflation. This increasing inflation disturbs the economy and balance of payment.

There is always a fluctuation in people buying behaviour which disturbs the government budgeted income. The government forecasted cash flow is not certain if there is recession in the economy or the people buying pattern will change.

Difficulty in tax calculation and collection are the drawbacks of indirect taxes. As these taxes start form raw material and the burden keep passing on to the final consumer but if any intermediary manipulate his transaction statistics there will be loss of revenue

LITRATURE REVIEW

ARTICLE- Price Elasticity and Imposing a Specific Tax on the Buyers of Cigarettes

Article considers the effect of a tax imposed by government upon cigarette. The demand curve is inelastic because consumers are addicted to cigarettes and will pay the extra burden to continue to smoke them .When prices increase due to tax (when demand is inelastic, the producer is able to pass all of an indirect tax to the consumer by increasing the market price) the quantity demanded decreases a very small amount. Government wanted to correct the negative externalities which smoking has with it by imposing a tax, the tax would have to be very large. The bigger the tax the more effect it will have on demand. Cigarettes have an inelastic demand curve, are income inelastic, and have no close substitutes therefore imposing a tax will only increase their government revenue and will not decrease the quantity demanded for cigarettes enough to solve all the costs that cigarettes bring.ARTICLE- The Final Incidence of Australian Indirect Taxes

The Australian Bureau of Statistics provides a breakdown by industry of the revenue collected from each of the major indirect taxes in Australia. This information does not show who bears the ultimate burden of indirect tax as each industry may pass on its initial burden to others. Thus, the burden of the tax may be passed on round by round to indirect business purchases and final demand until the total burden of the tax is passed onto the final consumer. Using a method to derive final indirect tax incidence developed from earlier studies, the final incidence of a selection of indirect taxes in Australia is presented. The major innovation is to include the use of margin industries in the initial flows of the input-output matrix ensuring that taxes on inputs to margin services are fully passed forward onto the good or service that the consumer purchases. It is found that many goods and services that are initially exempt from the main indirect taxes, such as the wholesale sales tax, have significant effective tax rates once taxes on inputs to industry are taken into account.

RESEARCH METHODELOGYI use secondary sources as research methodology to find out the hidden truth and research the problems related to Perception and Decision Making. I collected the data through the various sources to make my research effective.

Data is collected through various publications of books, journals, magazines and newspaper & internet websites to complete the research in a good track.FINDINGS

The main finding of this research is that indirect tax highly effect the consumers. Most of the indirect tax in paid by the consumers as producer forward taxes to them by increasing the end price. Some of the product have high indirect tax include in its prise such as cigarettes and liquor. These taxes effect the consumers by changing there equilibrium price. The middle fixed salry class suffer mostly by indirect tax.

There are also some competitive and highly elastic market where producer take the burden of the tax.

Government uses the indirect tax for some other social and economic reason also like the indirect tax like anti-dumping duty help to prevent home product demand tax on the addicted things which reduce there use frequency. So indirect tax are also a useful tool for the government.

Bibliography

• http://w-articles.com/web/files/33d91f7075237244e8234691e53102b6-7.html

• http://en.wikipedia.org/wiki/Tax

• http://onlinelibrary.wiley.com/doi/10.1111/1467-8462.00123/pdf